Legislation that would relax major post-financial crisis banking regulations moved one step closer to clearing the Senate and becoming law.

The upper chamber voted on Tuesday 67-32 to limit debate on the bill, setting the stage for its final passage later this week.

Sixteen Democrats backed the motion to advance the legislation; twelve of them are cosponsors. Senate Minority Leader Chuck Schumer (D-N.Y.) offered no criticism of the bill, in his regular morning remarks on Tuesday, just fifteen minutes before the vote. Every single Republican present backed the measure.

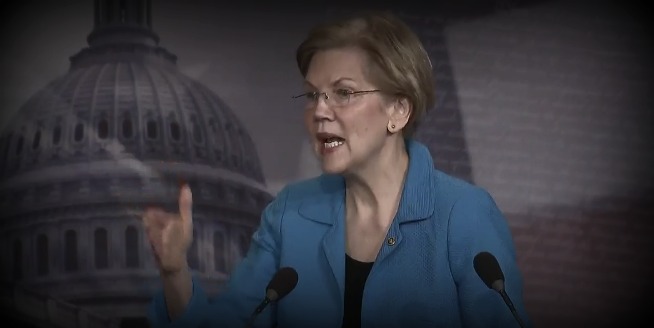

“People in Congress may have forgotten the crash ten years ago, but I guarantee people across this country have not forgotten,” said Elizabeth Warren (D-Mass.) at a press conference Tuesday morning.

Warren noted she would offer more than a dozen amendments–to try to mitigate the impact of the legislation, as it advances—though she also conceded she wasn’t sure how many, if any, would be allowed by Republican leaders.

“Nobody in Ohio apart from banking executives are clamoring for this bill,” Sherrod Brown (D-Ohio) also said in a floor speech ahead of the motion to proceed.

Brown is the lead Democrat on the Senate Banking Committee. Late last year, he walked away from negotiations over the bill with Chair Mike Crapo (R-Idaho), when he became concerned Republicans wanted too many deregulatory provisions for the country’s largest banks.

During her press conference, Warren was asked about the strong support this legislation was receiving from Democrats, and whether she was concerned that her criticism might harm them in an election year.

“There’s Democratic and Republican support because the lobbyists have been pushing since the first day Dodd-Frank passed,” Warren said. “It’s a demonstration of what’s wrong with Washington,” she added.

The legislation–the Economic Growth, Regulatory Relief, and Consumer Protection Act (S.2155)–would weaken rules upholding key laws protecting consumer lending, financial stability, and the ability of regulators to monitor the country’s largest financial institutions.

Among the bill’s more controversial provisions include a proposal to dilute reporting requirements enabling regulators to enforce laws prohibiting racial discrimination in lending. Other parts exempt 25 of the country’s biggest banks—those with between $50 billion and $250 billion in assets–from enhanced supervisory requirements passed after the 2008 financial crisis.

An analysis produced in December by Public Citizen found these latter provisions would relax rules on firms with about $3.5 trillion in assets. The same banks received $48 billion in emergency bailout funds after last decade’s market meltdown.

Adding fuel to the debate over this proposed rule change, the staid Congressional Budget Office said Monday that S.2155 would increase the chances that a major financial firm “will fail or that there will be a financial crisis.”

“CBO estimates that the probability is small under current law and would be slightly greater under the legislation,” the non-partisan office said.

Of note, the bill also changes a key word in Dodd-Frank, giving significant leverage to Wall Street lawyers.

Section 401 would require the Federal Reserve to tailor post-crisis rules to banks with more than $1 trillion in assets, stripping discretionary power from regulators (the decision to cater to banks also used to only apply to firms with no more than $250 billion in assets).

Warren singled out the push for criticism during her press conference, saying it hinged around replacing one word (“may”) in the law with another (“shall”).

“That one word change will allow the big banks to sue the Fed if they don’t weaken the rules the way the banks want,” Warren said.

During her press conference, Warren also scoffed at claims S.2155 was crafted to give regulatory relief to community banks, citing the size of proposed asset threshold hikes. She additionally noted that Countrywide–a firm at the heart of the subprime mortgage crisis–would see relaxed rules, if the bank still existed today.