It certainly looks sketchy, but Mick Mulvaney claims he had nothing to do with it.

The temporary head of the Consumer Financial Protection Bureau said that he exerted zero influence over the move to drop an investigation into payday lending giant World Acceptance Corporation, a firm that has donated thousands to his congressional campaign funds.

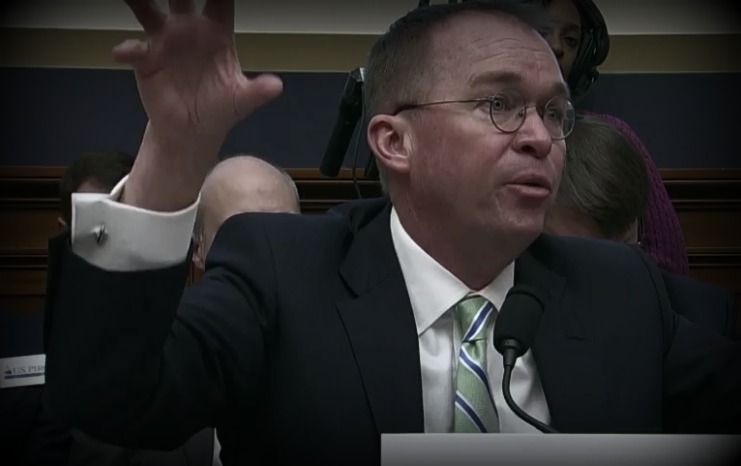

Mulvaney was asked about the dropped case at a congressional hearing on Wednesday by Maxine Waters (D-Calif.), the ranking member of the House Financial Services Committee.

Waters noted how in January, two days after World Acceptance announced the end of the inquiry, the company’s recently-former CEO, Janet Matricciani, personally thanked Mulvaney in an email. The message included Matricciani’s resume and a request to consider her as the next full-time CFPB Director.

Mulvaney replied to Waters line of inquiry by claiming the termination of the probe had nothing to do with his interim appointment to the CFPB—an agency Mulvaney ferociously criticized as a lawmaker; in part, due to its handling of payday lenders.

“Career staff recommended that it be dropped about the time I took over,” Mulvaney told Waters.

“Are you sure you want to answer that way?” she eventually replied

“Uhh yeah, ’cause it’s the truth,” Mulvaney answered.

“We will find out more about this,” Waters said, when concluding her round of questioning.

The payday reversal and the World Acceptance case are among a number of controversial actions undertaken by Mulvaney.

The top White House budget aide has also stopped payments to defrauded consumers and halted agency data collection. Meanwhile, he has staffed the Bureau with political operatives who have close ties to the financial industry.

Though Mulvaney has justified his actions by claiming he wants to foster transparency and accountability, his critics say he is doing favors to commercial interests that have been supportive throughout a career full of hard-line antics.

Mulvaney, for example, led the charge during the Tea Party Congress to force through austerity spending cuts by threatening a completely self-inflicted sovereign default by the US government.

One Democratic lawmaker seized on reports of Mulvaney’s office habits to poke holes in his claims about fighting opacity. Rep. Keith Ellison (D-Minn.) grilled the interim Director about the installation of frosted glass on inward-facing office windows.

Ellison also asked Mulvaney if the interim CFPB director has been using a Virtual Private Network or VPN—a technological device used to strengthen digital privacy.

“I don’t think so,” Mulvaney said. “Did I?”

“We’ll see. I guess a reporter out there will look into it,” Ellison replied.

As a handful of Democratic lawmakers noted, the legitimacy of Mulvaney’s interim appointment is still under judicial review. The DC Circuit Court of Appeals is set on Thursday to hear oral arguments in the case.